Springfield to Host GovCon 2025: Connecting Businesses with Government Contracting Opportunities

Event to be held at efactory Aug. 27. Local businesses interested in breaking into or expanding within the world of government contracting are invited to attend Springfield Business GovCon 2025, a full-day event taking place on Aug. 27 at Missouri State University’s efactory, located at 405 N. Jefferson Avenue. GovCon 2025 is a collaborative event […]

Unleashing Creativity & Driving Success: The Brick City Design Studio

MSU A+D students providing no-cost design assistance for efactory members.

Join the Student Employment Office as Our New Part-Time Administrative Assistant

Connecting students to opportunities and employers to talent. Are you looking for a role where your organizational skills, attention to detail, and enthusiasm for student success can truly shine? The Student Employment Office at Missouri State University is excited to announce an opening for a Part-Time Administrative Assistant. At Student Employment, we help students launch […]

From App Pro to Chief Venture Officer

Jody Chaffin’s Full-Circle Startup Story.

We’re Growing our Team: Apply for the New Regional Small Business Consultant Position

We’re looking for someone like you!

From Classroom to Catastrophe (Response!)

Ayden O’Connor’s Entrepreneurial Dive with Halo RRS.

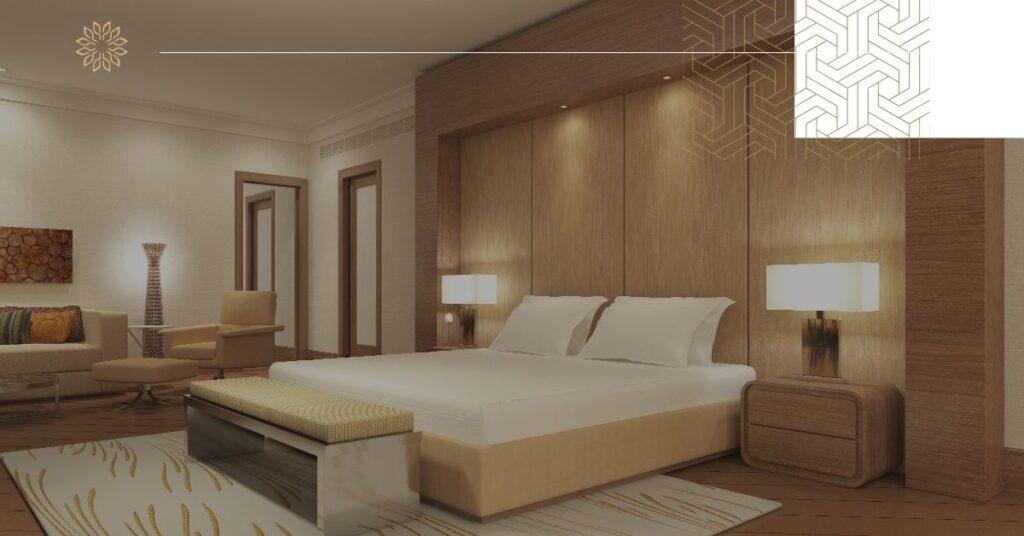

New Member Perk: Your Summer Escape Just Got Sweeter (Thanks, Nightly!)

Love to share perks with our members!

A Taste of Afghanistan Comes to Branson

Meet Ali Eftekhari and Bamyan Kabob.

Exciting New Partnerships with the Missouri Chamber of Commerce and Industry and Missouri Association of Manufacturers

Expanding Our Reach and Unlocking Potential Across Missouri.

Missouri State University’s efactory Receives More Than $2.9 Million Missouri Technical Assistance Grant in Partnership with Codefi to Expand Access to Capital Across Missouri

Funding allows technical assistance programs to be offered statewide.