Get to know us

Missouri SBDC at MSU

We Exist to Help You

We help businesses thrive through a dynamic mix of coaching, mentoring, training and technical assistance. Our expert team regularly helps business leaders and entrepreneurs with business planning, market research, talent development and more.

Our Passion is Your Business

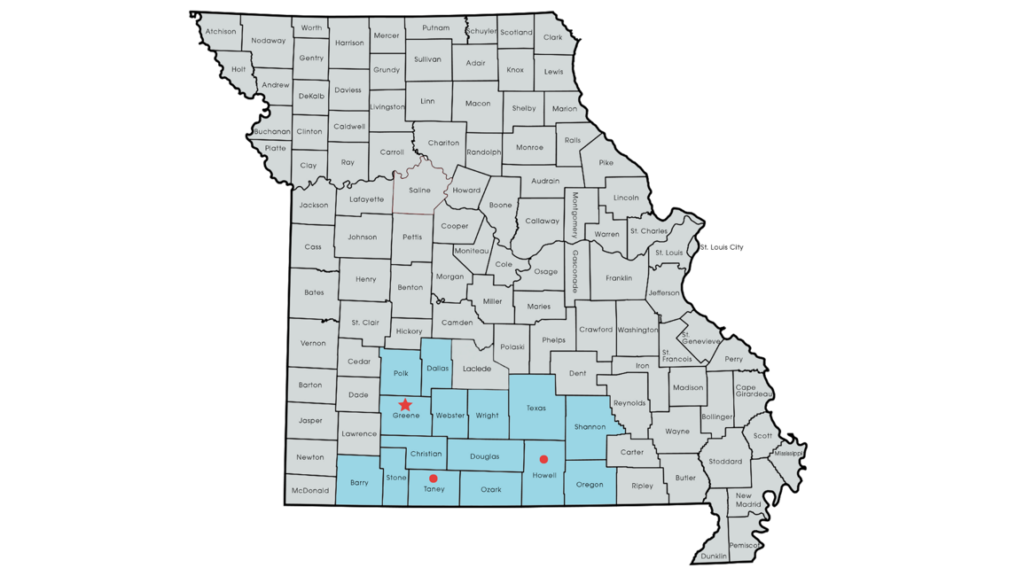

The Missouri Small Business Development Center (SBDC) at Missouri State University is a leading resource for growing and developing businesses, serving 15 counties in southwest Missouri.

With offices located in Springfield, Forsyth and West Plains, the Missouri SBDC at MSU offers one-on-one consulting and training to business owners and leaders. As part of the efactory’s business support program, the MSU SBDC helps accelerate Missouri’s economy by offering business consulting, training and workforce development solutions.

Local Offices, National Expertise

The Missouri SBDC is part of a larger state and nationwide network of business resource programs, funded in part through the University of Missouri Office of Extenstion and the U.S. Small Business Administration. SBDC offices help businesses in every stage, from startup to succession.

Meet The Team

We work together as a team of entrepreneurs, innovators and problem solvers to serve clients. Together with corporate partners and resource organizations, we serve startups and small businesses throughout southwest Missouri.

Who We Serve

Our office in Springfield, Missouri, serves entrepreneurs and small business owners in the following counties: Barry, Christian, Dallas, Douglas, Greene, Howell, Oregon, Ozark, Polk, Shannon, Stone, Taney, Texas, Webster and Wright.

Our West Plains center serves entrepreneurs in seven counties across the south-central Missouri Ozarks region: Douglas, Howell, Oregon, Ozark, Shannon, Texas and Wright.

Our center is part of a statewide network. Find the closest SBDC office to you through our statewide website.

Frequently Asked Questions

Learn more about our center and find answers to frequently asked questions.

Becoming a SBDC Client

The Missouri SBDC at MSU is not the SBA. We are partners with and receive a large portion of our funding from the SBA. As a separate program, the SBA does not have access to our client records or databases nor do we have access to theirs.

Our staff provides expert assistance in all areas of business operations from starting your business to succession planning through 1:1 meetings and low-cost business training. We do not provide legal or tax advice; however, we are happy to discuss questions that you should ask your attorney or accountant. All information shared with us is confidential. Schedule an introductory meeting to learn more about services to help your business: Start Your Business or Grow Your Business.

Our office in Springfield, Missouri, serves entrepreneurs and small business owners in the following counties: Barry, Christian, Dallas, Douglas, Greene, Howell, Oregon, Ozark, Polk, Shannon, Stone, Taney, Texas, Shannon, Webster and Wright.

Our West Plains center serves entrepreneurs in seven counties across the South Central Missouri Ozarks region: Douglas, Howell, Oregon, Ozark, Shannon, Texas and Wright.

Our center is part of a statewide network. Find the closest SBDC office to you through our statewide website.

Training, workforce development and strategic planning are open to all businesses and not for profits. The no cost 1:1 consultations covered by our SBA grant are available to entrepreneurs and business owners of for profit businesses based on SBA size standards (SBA Size Standards). There are certain types of businesses that are not eligible due to federal funding we receive. If you are not sure whether your business idea or business is eligible, reach out to us to check.

There is no fee for 1:1 consulting through the SBDC. We do request business metrics from clients so we are able to continue to receive funding for our program. All of the information is confidential and only reported in aggregate to our funding agencies.

Book a meeting online and complete our online client signup through the link you receive.

The SBDC is required to collect business metrics (business start, gross sales, export sales, number of jobs, loans and equity and occasional surveys) to track impact for future funding so we can continue to provide our 1:1 services at no cost to clients. All of your information is confidential and only reported in aggregate to our funding agencies.

You can continue to utilize the services of the SBDC as long as you are making progress toward your business goals. Meeting frequency varies and is based on your needs.

You will be assigned a primary consultant, but could meet with other consultants on our team based on their expertise and your needs.

Financing For Your Business

The SBDC does not provide loans or grants for businesses; however, we work with you to identify the best funding options for your business and help you through the application process.

While there are many grant opportunities available, they are usually NOT focused on starting or expanding for profit businesses. Most grants have a very narrow focus to address a specific need (ie. developing rural broadband access) and you should plan to explore other funding options to start or expand your business.

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs support federal government research needs. These highly competitive grant and contract-based federal programs support research and development with the potential for commercialization.

Yes, you need financial projections to apply for a loan. Requirements can vary by lender and loan type. Our office provides assistance in developing financial projections for your startup or existing business. We recommend the following statements for a three-year time period: Income Statement, Balance Sheet and Cash Flow Statement. The Income Statement and Cash Flow Statement should be monthly for year one and can be annual for years two and three.

Yes, you will need to contribute some of your own money to the business. The required amount can vary, but a minimum of 10% equity is required for SBA guaranteed loans and some lenders require 20% or more equity depending on the business.

There are multiple factors lenders review when deciding on whether to fund a loan application. Lenders usually look at the “Five C’s” of credit: capacity, collateral, capital, character and conditions. Each lender may have a variety of other factors they take into account, but their focus is making sure their loan will be repaid. Lenders want to understand your business and reason for borrowing funds, along with reviewing your personal credit score, projected cash flow and debt service coverage ratio.

Your personal credit score is an important factor in the ability to obtain financing for your business. A higher credit score may make it easier for you to obtain financing. If your credit score is not at the level necessary to obtain traditional financing, there are programs that provide credit building assistance and microloans.

Managing a Business

Yes, you can meet 1:1 with an SBDC consultant to review your financial statements and compare your performance to other businesses in your industry. Your financial statements tell a story about your business, and timely review allows you to make informed decisions to move your business forward and increase profitability.

Executive coaching is a process that creates a safe, structured environment for senior business leaders to work through business decisions or challenges. It is distinct from consulting in that no advice is given in a coaching session. Instead, selective questions allow leaders to examine topics from new perspectives to find solutions. Executive coaching is a service covered by our funding agencies.

Strategic planning is a process to help a business define goals, set priorities and manage resources. Businesses of any size can benefit from strategic planning. The amount of detail and formality of a strategic plan varies greatly depending on the size of the business. Our team has several tools and methods to help you create an actionable strategic plan for your business needs.

The IRS has specific guidelines on who can be considered contractors instead of employees. Typically, if a business has the right to control or direct how a job is to be done, then that person is considered an employee. If a business is only controlling what job needs to be done, the person might be considered a contractor. Misclassifying an employee as a contractor could make the business liable for back employment taxes. Please visit IRS – Understanding Employee vs. Contractor Designation for more information.

There are many programs available to help your business start exporting or expand into additional markets. The Missouri Department of Economic Development International Trade Office has the State Trade and Export Promotion (STEP) grant program and the Global Market Access Program (G-MAP). The USDA and Missouri Department of Agriculture also have programs to support businesses in exporting. We are happy to meet with you 1:1 to discuss exporting your products or services and provide assistance with your export plan.

Succession planning is the process of developing a plan for current ownership to exit the business and identifying the next generation of ownership. This can include accounting strategies, business valuation and management development. Often this process is done with the help of trusted advisors (CPA, Attorney, Consultants) and is ideally implemented over several years leading up to ownership transfer. It is never too early to begin developing your succession plan.

Starting a New Business

In most cases, yes, you need to have a business license for online businesses. The types of licenses and registrations vary depending on your industry and location. Please reach out to our team to discuss your situation and ensure you have the proper licenses in place.

Yes, you need a business plan. This is your road map for converting your concept into an actual business. If you are looking for funding, lenders will require a complete business plan. Requirements can vary by lender and loan type.

There is no fee to apply for an EIN. Visit Apply for an Employer Identification Number (EIN) Online to learn more.

This depends on your specific needs and goals. We recommend you meet with a trusted advisor to discuss business structures. You can find information on different business structures at Missouri Secretary of State – Starting a Business. Book a meeting with our team to discuss the advantages and disadvantages of different entity structures.

Depending on industry and location, you may need special permits or licenses. Please reach out to our team to discuss what specific licenses and permits your business may require.

We recommend meeting with a business advisor from the Missouri SBDC first to determine your next steps. Market research, a good business plan and financial projections are often essential.

Training and Education

There is a fee for most of our professional development and business training programs. Our training is led by industry experts offering timely and relevant information.

We recommend registering at least a week in advance of the program you wish to attend.

We offer discounts on our training programs for sending three or more participants to a particular topic (larger discounts are available for larger groups, contact our office for more information). We also offer discounts to efactory members and partner providers.

Yes, we can develop custom training solutions designed to meet your specific needs. Custom training is quoted per project, based upon your organization’s request. Tell us how we can help design a custom training program for your business.

To cancel, you will need to email or contact us by telephone at least two business days prior to the training event to be eligible for a full refund. If more than two business days are required for refunds for certain programs, you would be notified of that at the time of registration. Special exceptions to the two-business day policy will be considered for serious life events.

Around the Region

Need access to business resources in your local community? We’ve got you covered.