The Missouri Small Business Development Center (SBDC) at Missouri State University – West Plains helps both established small businesses and those just beginning. We work with Missouri entrepreneurs and small businesses that are for-profit (not a non-profit charitable or educational organization). Whether you are currently in business or thinking about starting a business, the SBDC can assist you in your venture.

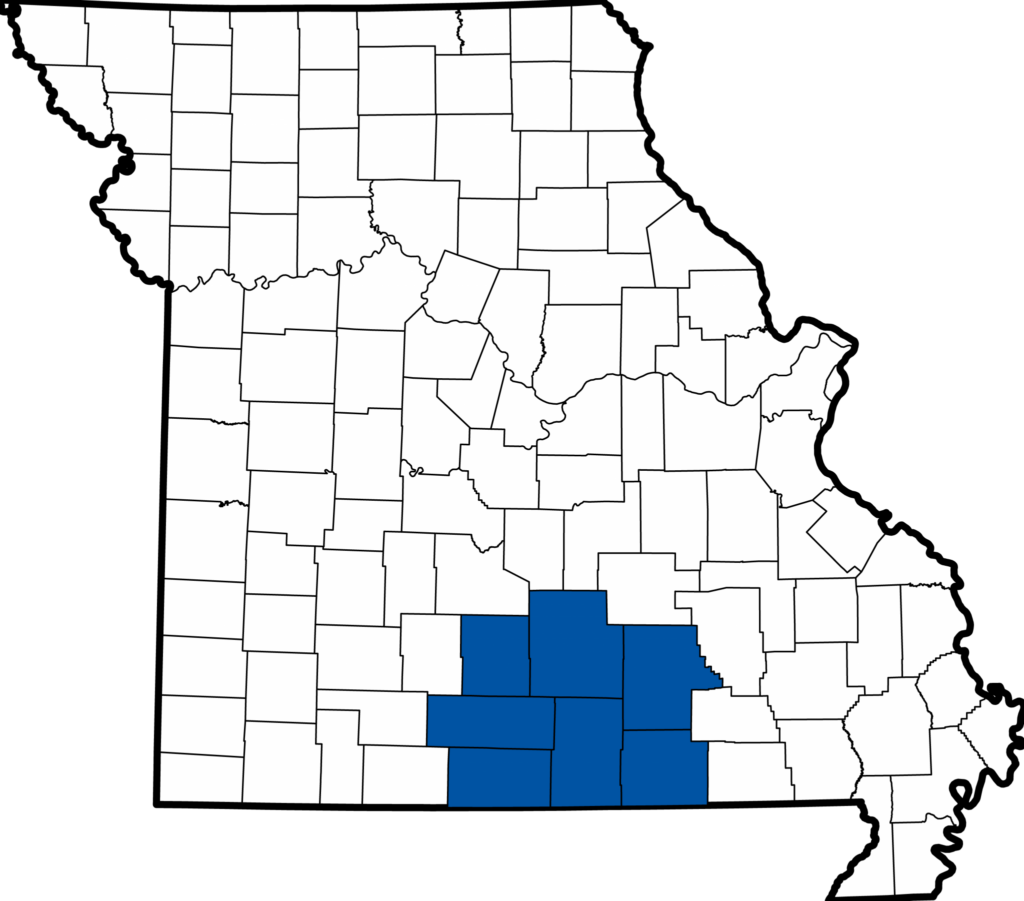

We serve entrepreneurs in seven counties across the South Central Missouri Ozarks region: Douglas, Howell, Oregon, Ozark, Shannon, Texas and Wright.

We provide no cost 1:1 consultations that will help you start your business on solid footing. Schedule a quick, 10-minute introductory call to learn how we can help.

The experts at the Missouri Small Business Development Center at Missouri State University – West Plains are committed to helping your business grow. We understand the successes and struggles business owners experience. When you work with the SBDC, you have a team dedicated to helping you succeed.

Find answers to our most frequently asked questions below. If you have other questions please email us or call (417) 255-5374.

Yes, we can help. New clients must first complete the SBA 641 Form. We cannot consult with anyone until this form has been received. After we receive the SBA 641 Form, clients are eligible to schedule an appointment.

You are not required to bring anything to your appointment. Initial meetings are usually spent getting to understand where you are in your business and what challenges or opportunities are on your mind. We will introduce you to our services and develop a plan for moving forward. For a more productive meeting, it is helpful if you can complete the Client Online Assessment.

For existing businesses, it is also helpful to provide a one-page executive summary and a copy of your most recent financial statements. Additionally, if you have a business plan that you would like to have reviewed, please submit the document at least one week in advance to allow time for proper feedback.

The Missouri SBDC will never charge a fee for private consulting or coaching services but we do charge a nominal fee for business training and specialized services.

The Missouri SBDC is supported by federal and state programs to provide confidential one-on-one business consulting. Please note that while our professional business consulting services are available at no cost to eligible small businesses, appointments are required in advance. The SBDC is obliged to account for the clients we serve, the services we provide, and the client outcomes resulting from our assistance. The continuation of our grant funding is dependent upon the economic impact of our clients. Accordingly, we respectfully require all clients seeking one-on-one appointments to comply with our office protocol. We are responsible and accountable for our time spent.

Our SBDC service area in the West Plains office covers clients in the seven-counties of Douglas, Howell, Oregon, Ozark, Shannon, Texas and Wright. However, we are allowed to work with clients in any contiguous Arkansas county. We recommend you work with the SBDC office nearest you; we are the closest SBDC office for many people who live in Northern Arkansas.

The guidelines for small businesses, include:

The Missouri SBDC is funded in part through a Cooperative Agreement with the U.S. Small Business Administration. The Missouri SBDC at MSU is a University of Missouri Extension Partner.

The Missouri SBDC is funded in part through a Cooperative Agreement with the U.S. Small Business Administration. The Missouri SBDC at MSU is a University of Missouri Extension Partner.